Scenario Planning for 2021

I talk a lot about planning your experiment as you Ride the Ramp. And measuring. And iterating. I did not discuss what to do when you encounter historically disruptive events, like a global pandemic.

And what I recommend you do is usually reserved for large, multinational companies highly exposed to socio-political conflict globally. It’s called scenario planning. They want to be ready when Russian turns off its oil/gas exports and invades the former Soviet Union. You, however, don’t care about that kind of low probability event.

Luckily, scenario planning is vastly more straightforward for early-stage brands than for Exxon Mobil. For one thing, you’ll look at scenarios at the beginning of the disruptive event, not years ahead of time.

And, you only really need to look at 2-3, using publicly available data you have access to right now.

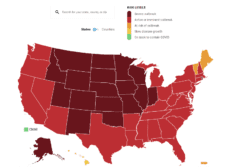

In my Sept. webinar, I reviewed the three key uncertainties affecting almost all the disruptions affecting you during the COVID-19 pandemic –

- Further Stimulus of the Under-Employed – propping up middle-class trade up to premium

- Vaccine Effectiveness – affecting the public’s willingness to hang in public and attend large outdoor events

- Case Positivity Post-Vaccine – see above

It led me to two scenarios regarding the length of the CPG surge and disruption to public events, large gatherings, and mobility. The former Combined, these uncertainties create long and short pandemic scenarios that affect two things of importance to you: a) the extent and length of the CPG demand surge and b) the willingness of the public to show up at large public events, frequent out-of-home restaurant venues and engage in ‘specialty’ food shopping (related heavily to parties, at-home events, work events, etc.)

The former (the CPG demand surge) affects supply-chain, shelf-set arrangements for high-velocity brands, willingness to onboard very new brands (that yield no immediate financial benefit to the retailer), co-man run time availability, ingredient supplies, and 3P shipping efficiencies. These are mostly operational drags on servicing the demand for your products. The demand for most CPG categories is still up.

The latter (public behavior patterns) is a headwind for those of you using out-of-home channels to generate initial trial, cash flow, proof-of-concept, and conduct field marketing/sampling operations.

This upcoming Wednesday, I’ll be updating my view on these scenarios and timing as it relates to planning 2021…or flexing 2021.

Hope to see you at that live webinar event!