How the Pandemic Revealed How Category Matters

Last April, I held two webinars on the early effects of the COVID-19 lockdowns on category consumption rates. It proved an extreme tool with which to teach some essential variables driving baseline category velocity.

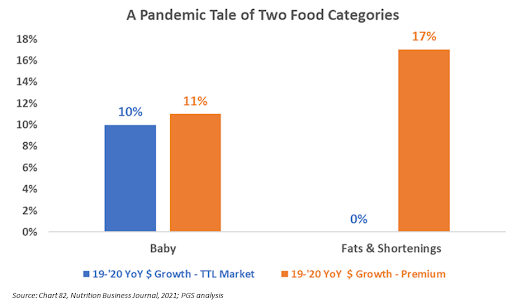

Category is everything in strategic planning for exponential B2C growth. Compare how baby food fared vs. butter/shortening during the pandemic. Only one of these two went premium during year one of the pandemic.

If you sell in either of these two, you should already know why this happened…but do you?

Well, part of the answer has to do with Total Addressable Market: how many households are even slightly predisposed. With the birth rate among educated women declining, the audience for premium baby food is becoming a genuinely red ocean, oversupplied with options.

Another part of the answer relates to the latest wave of innovation and its ability to command a premium price (or not). The data is revealing that baby food’s latest wave (ultra-fresh and ultra-pure) just isn’t commanding a large audience even after six years from multiple brands. Organic baby food, folks, may have been the last considerable disruption in what is ultimately a highly constrained category in which the target consumer ages out quickly amidst massive cultural distraction from mac-n-cheese and other snacky carbs.

More variables explain why premium baby food couldn’t gain market share despite being much higher priced per unit.

My point here is simple: Be the category expert. This costs no more than time spent listening closely to your fans.

If you’d like more in-depth thoughts, please register to listen to my on-demand analysis of 2020 categories