Beyond Predictable – Beyond Meat’s Struggles Are Explainable

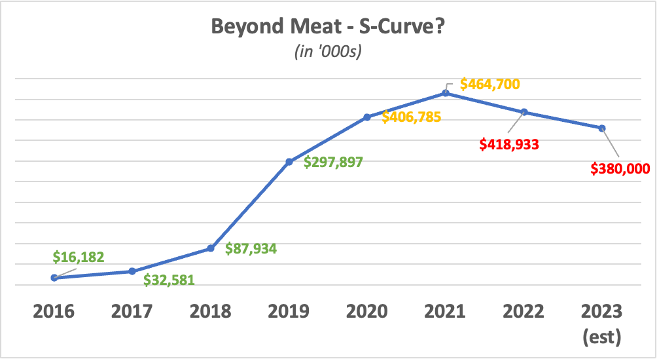

As of 5:00 PM EDT on Thursday, May 10, 2023, Beyond Meat has created a highly seasonal, lower midmarket, negative EBITDA business that peaked at $464M in annualized sales in 2021. Here is the annual net revenue trend since 2016, which I’ll return to shortly.5

Recent quarterly trends reveal a significant seasonal spike typical of beef patties and a declining YoY baseline (globally and in US retail). More concerning is the worsening seasonal trough, suggesting that the ‘summer repeat rate’ is worsening as the brand moves deeper into less friendly retail and food service territory full of 99% carnivorous shoppers.6

Finally, the crude $/outlets of distribution sell-in velocity of the business is declining, excluding any impact of Beyond Jerky. If sell-in is declining, sell-through is definitely declining, potentially even faster if retail warehouses were stuffed.

In lay terms, a cash register velocity decline means that Beyond Meat has a repeat purchase rate problem. It most likely also has a household penetration problem in its core, revenue-generating UPCs (the older ones). Launching new frozen products may add households (and sales), but it has to add them at a rate that compensates for the lack of proper household retention in the core patty/sausage/ground business. A leaky bucket of households is disastrous for any consumer business.

I’m surprised that Wall Street is not asking for essential marketing KPI information like household penetration and repeat purchase rates to be made public and for analytical separation of the ‘core’ from the newer parts of the business.

For more of my diagnosis, please visit the Food Institute – HERE