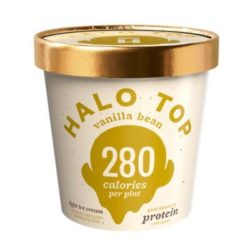

Do You Know Your Brand’s Key Attribute?

One of the enduring challenges in premium CPG innovation is that the founder(s) are usually category geeks. This makes it hard for these founders to accept that even their early fans may not be so geeky. Fans may routinely gravitate to a specific attribute embedded in your offering. Differing groups of fans may gravitate